DBS bank says consumer, SME banking is its 'jewel in the crown'

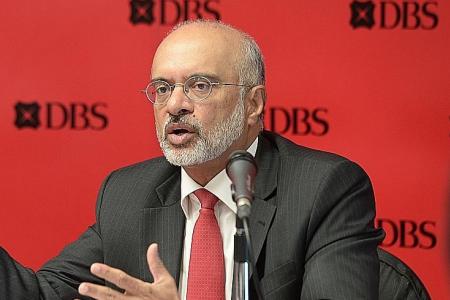

The consumer and small and medium-sized enterprise (SME) banking business in Singapore and Hong Kong is DBS Group's "jewel in the crown", that could contribute half of the bank's income in five years, chief executive officer Piyush Gupta said earlier this week.

Speaking to about 80 analysts and investors from around the world about DBS' digital strategy, Mr Gupta noted that between 2015 and this year, this business has posted a compound annual growth rate of 11 per cent, far outpacing the overall 4 per cent growth recorded across the whole bank.

At the same time, its cost-to-income ratio has fallen from 49 per cent in 2015 to 43 per cent this year, while return on equity (ROE) has risen from 22 per cent in 2015 to 24 per cent this year.

Income for the business, which reached $5.1 billion this year, will likely continue to grow at a double-digit pace and has the potential to make up 50 per cent of the bank's total income within the next five years, up from 44 per cent today, Mr Gupta added.

A factor fuelling this growth is DBS' digital transformation since 2014, he said, which has involved using data analytics to increase customer acquisition through wider distribution, eliminate paper and drive "sticky" customer behaviour by cross-selling products through contextual marketing.

In the consumer and SME banking business in Singapore and Hong Kong, this digital push was largely aimed at pre-empting industry disruptors.

However, in growth markets such as Indonesia and India, the aim is to be the disruptor. To that end, DBS has launched a fully digital bank in both markets. These are still nascent and loss-making, Mr Gupta noted, but are "a bet on the future".

Income growth from this is likely to be over 20 per cent in future, with the potential to contribute about 10 per cent of the bank's income in five years.

DBS' strategy to leverage on Asia's mega trends has paid off with diversified growth and higher returns, Mr Gupta said.

"Our digital transformation is pervasive, encompassing technology, customer journey and a start-up culture. This is difficult to replicate and creates competitive advantage," he said. - THE STRAITS TIMES

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now