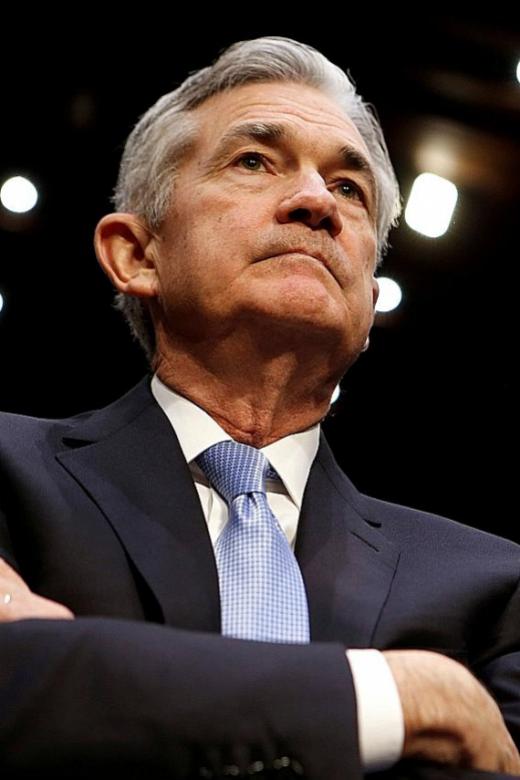

Powell takes over as Federal Reserve chair

He faces difficult decision over how fast to raise interest rates

WASHINGTON

Mr Jerome "Jay" Powell, the Republican former investment banker tapped by United States President Donald Trump to lead the US Federal Reserve, will take the reins of monetary policy starting today.

Perhaps the wealthiest Fed chair, Mr Powell, who turned 65 yesterday, succeeds Ms Janet Yellen, who ends the first and only term held by a woman.

He takes over at a remarkably quiet time following a decade of economic turmoil that forced the central bank into uncharted policy waters to try to recover from the global financial crisis.

Nevertheless, Mr Powell, one of the rare non-economists to fill the role, could soon face difficult decisions that will put him at the centre of debate over how fast to raise interest rates.

Wages last month posted the biggest annual increase in nearly 10 years, with the growing US economy adding jobs at a solid pace, while business and consumer confidence remains high just as a massive corporate tax reform starts to take effect.

This comes at a time when all major global economies are growing simultaneously, an unusual and happy coincidence, but one that begins to raise concerns about when the recovery will end - and how.

"His biggest challenge will be leading the further calibration of interest rates when the US economy is late cycle amid a synchronised global economic upswing and fiscal stimulus is on its way," Oxford Economics' Kathy Bostjancic said.

As Ms Yellen departs, the only Fed chair in nearly 40 years not to be reappointed for a second term, she leaves an economy with unemployment at a 17-year low of 4.1 per cent - half the rate when she became chair - quiet inflation and nearly four years of uninterrupted growth.

Plus, she steered the Fed out of its massive bond buying programme and began the process of "normalisation", or reducing the size of investment holdings, without upsetting the skittish financial markets.

She prevailed in the debate to raise interest rates only gradually to ensure the economic recovery was on solid footing. The Fed has raised the key lending rate five times in her tenure, including three times last year.

The Fed in December indicated that another three hikes were likely this year. But the minutes of the meeting show there was heated debate among the policymakers about how quickly they would need to move this year based on differing outlooks for inflation and the impact of the tax cuts.

Inflation has remained stubbornly below the Fed's 2 per cent target, but the policy statement last week said it expects prices to move up in the near term.

The first rate increase of this year is widely expected to come next month, which also will feature the first press conference by Mr Powell, who has served on the Fed board since 2012.

"Massive fiscal policy piled on top of an economy that was growing solidly and has limited labour availability has not been tried before," economist Joel Naroff said.

"How this 'Grand Fiscal Experiment' affects wage and price inflation is something the Fed has to be worried about."- AFP

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now