Singapore economy could end year on a high note

Private sector economists raise this year's growth forecast to 3.3%, up from 2.5% in September

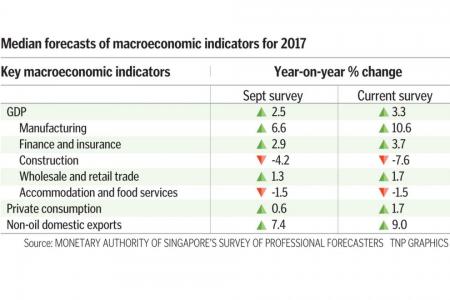

The economy could cap off this year on a good note with private sector economists tipping full-year growth to come in at 3.3 per cent, up from a 2.5 per cent forecast in September.

They also expect the growth momentum to continue next year, albeit at a more moderated pace with a 3 per cent full-year expansion.

The forecasts come from a Monetary Authority of Singapore (MAS) survey that elicited responses from 23 economists and analysts.

Their expectations are in line with predictions by the Ministry of Trade and Industry (MTI), which recently upgraded its 2017 growth estimate to 3 per cent to 3.5 per cent, up from 2 per cent to 3 per cent.

The MTI expects the economy to expand between 1.5 per cent to 3.5 per cent next year, with growth likely to come in around the middle of the range.

Despite a seemingly slower expansion projected for next year, economists said growth is expected to be more balanced and less driven by electronics than this year.

OCBC economist Selena Ling noted: "When we started the year, the recovery was very much about manufacturing and electronics.

"But over time, the optimism has spread. Interestingly, this is no longer a manufacturing story, and the growth drivers have expanded to services, particularly financial services and tourism-related services."

EASE

With semiconductor demand likely to ease in the coming quarters, there are signs that services will pick up the slack.

DBS economist Irvin Seah said: "Drivers of the economy could interchange, with services likely to take a commanding position in the coming years."

A turnaround in services - which comprises two-thirds of the economy - is significant as it makes growth more sustainable, he added.

The forecasts for most economic indicators next year are looking up compared with this year, including finance and insurance, wholesale and retail trade, construction, accommodation and food services, and private consumption.

Economists also expect headline inflation to go up to 1 per cent next year from 0.6 per cent this year.

Core inflation could rise from 1.5 per cent to 1.6 per cent.

Unemployment is projected to be 2.1 per cent at the end of next year - slightly up from the 2.2 per cent forecast for this year.

The top risks for the local economy continue to be a slowdown in China, geopolitical concerns and trade protectionism.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now