Investors in moneylending firm want their $4m back

They invested in a moneylending company here but are now desperate to get their money back.

They alleged that they have not received any returns since 2012 and attempts to get their principal sums back were unsuccessful.

At least 49 people have come forward to claim that they pumped in a total of about $4 million into the firm.

Some of them were childhood friends of the company's manager, Mr Murali Krishnan Naidu.

His wife, Madam Santhi M. K, is listed as the owner of the firm, San Tee Credit, which was registered in 2006.

They claimed that the couple are no longer contactable. Two police reports have been made and three lawsuits filed against Madam Santhi.

One police report, representing 32 investors who said they had invested $3.13 million, said they had "not received the promised full investment and principal payouts" from San Tee Credit.

Nine investors told The New Paper last week how they invested their life savings in the company.

A 44-year-old part-time taxi driver, who wanted to be known only as Sam, said: "I went to school with the both of them (Mr Murali and Madam Santhi). They were then dating each other. I am hurt that they have disappeared."

He said he had invested about $190,000 of his life savings starting from 2010.

Like most of the investors, he was promised a 2.5 per cent to 3.5 per cent return on his investment every month.

He is now in debt and lives "hand to mouth" each day, he said.

Sam said the monthly returns were initially paid to investors .

But around 2012, the payments stopped, said another investor, who wanted to be known only as Mr Raja.

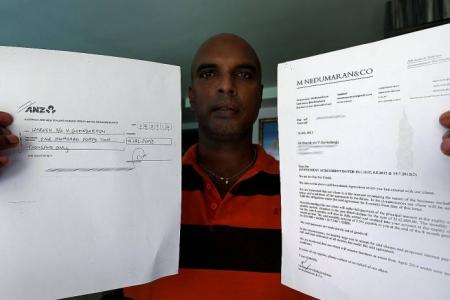

He said he put $130,000 into the company in 2010 and claimed he had also given about $40,000 to Mr Murali as a personal loan.

The investors were told in a 2013 letter from San Tee Credit's law firm, M. Nedumaran & Co, that the company was "revamping the nature of business" and was not able to fulfil its obligation to make the monthly payments.

OVERSEAS INVESTMENT

In March last year, Mr M. Nedumaran wrote to some investors to tell them that San Tee Credit's money was stuck in the Philippines.

The company had apparently invested 139 million Philippine pesos (S$4.1 million) in two moneylending businesses that provided loans to soldiers there.

A lawyer in the Philippines, engaged by San Tee Credit, sent letters of demand to the two companies stating that legal action would be taken if they refused to pay the company its interest payments and return the money it had invested.

This letter was sent to the investors in Singapore.

Said Mr Raja: "It was the first time I learnt that my money was being invested overseas. All along, I thought I was investing in San Tee Credit's moneylending business here.

"Nowhere in our contract did it mention investments in the Philippines."

He said some investors blamed him for their predicament as he had previously worked for Mr Murali for five years in another company.

"Many investors and family members called me to say 'I should have known better'. But the truth is, I'm equally disappointed because I trusted him," he said.

Mr Raja said he last spoke to Mr Murali in April last year when he told Mr Raja that he needed time to return his investment.

Two months later, Mr Murali's mobile phone line was no longer in use.

The investors' problems came to light in a bizarre incident last October. Several investors who had been searching for Mr Murali spotted him as he was driving into a condominium at King Albert Park in Bukit Timah.

One of them, Mr Haresh Govindaraju, 47, tried to confront him.

When Mr Murali continued driving, Mr Haresh ended up on the car bonnet and had to cling on for his life for 5km until Mr Murali stopped at a police post in Bukit Batok and left, leaving his wife behind.

Both Madam Santhi and Mr Haresh made police reports about the incident, which was captured on video and went viral on citizen journalism portal Stomp. The New Paper also reported on the incident on Oct 22.

Mr Haresh later told TNP last December that he had invested close to $142,000.

"We were childhood friends. All I wanted was to talk to him and ask him about our money," he said.

TNP made three attempts - between last October and this month - to speak to Mr Murali but was told by Mr Nedumaran that his client was overseas. E-mails to him also went unanswered.

When TNP went to Mr Murali's registered HDB address in Yishun and San Tee Credit's premises at Genting Lane last October, nobody answered the door.

And when TNP called Ms Edna Jakosalem, a Filipina who had taken two other Filipinos to court over their delayed payments to San Tee Credit's moneylending investment, somebody picked up the phone but then hung up.

Three lawsuits were filed against Madam Santhi last year - two in April and one in May.

The plaintiffs had demanded a total of $690,000. The highest claim was made by Mr K. Premmananth for $503,000.

As no defence was filed, the State Courts ruled in favour of the plaintiffs.

But they have yet to get their money back because the couple remain uncontactable.

Many investors and family members called me to say 'I should have known better'. But the truth is, I'm equally disappointed because I trusted him.

- Mr Raja who introduced other investors to Mr Murali Krishnan Naidu

We were childhood friends. All I wanted was to talk to him and ask him about our money.

- Mr Haresh

ABOUT THE CASE

The investors' plight becomes known after The New Paper reported last October about Mr Haresh Govindaraju clinging onto the bonnet of a car driven by Mr Murali Krishnan Naidu, a manager of San Tee Credit.

Mr Haresh is one of 49 investors who claim to have invested $4 million, ranging from $5,000 to $350,000 each, in San Tee Credit.

They claim they have not received any returns on their investment since 2012 or got back their principal sums.

They have made two police reports, with one report representing 32 investors.

Litigation records show that three investors have sued the owner of San Tee Credit, Madam Santhi M.K, who is Mr Murali's wife.

If it's too good to be true...

Government agencies like the Monetary Authority of Singapore (MAS) and the police Commercial Affairs Department (CAD) have cautioned the public about the risks behind some investment schemes.

If an investment sounds too good to be true - meaning it claims to yield high returns in a short time - then it probably is.

Potential investors should check the legitimacy of the company offering the investment programme.

MAS recommends investing your money with MAS-regulated financial entities.

An investor will not have the protection "afforded under the regulatory framework administered by MAS" when dealing with unregulated financial services. Getting assistance could be difficult particularly if the operator is based overseas.

UNREGULATED

Some common unregulated financial schemes mentioned on the MAS website include virtual currencies, overseas property schemes and gold "buy-back" offers.

The website also states the risks related to some financial products and maintains an "investor alert list" of unregulated investment companies.

In April 2013, there were 162 such companies on the list. Today, there are 182.

The CAD warns the public to be alert of various scams that target Singaporeans.

Investment scams such as high-yield investment programmes, illegal pyramid selling and Ponzi schemes are detailed on its website, along with how the scams work.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now