Freehold Sun Rosier goes en bloc for $271m

78-unit estate off Bartley Road snapped up by Chinese investor

If location is key in real estate, so is timing, as a former owner at Sun Rosier can attest - after he sold too early and missed a multimillion-dollar jackpot from the condominium's collective sale this week.

That has got to hurt, but think of the lucky buyer who snapped up the 2,336 sq ft unit in April for $1.92 million and is now about to pocket an estimated $4.4 million - a remarkable profit of $2.48 million in five months, give or take some taxes.

The eye-watering good luck/bad luck tale is due to the bumper collective sale pulled off by the 78-unit estate off Bartley Road.

Freehold Sun Rosier has gone for $271 million - or about $1,885 per sq ft (psf) - topping the asking price by around 15 per cent. The owners stand to reap between $2.86 million and $4.77 million each.

Three of the four collective sale offers "were very close to each other", marketing agent Huttons Asia said yesterday, with a joint venture between SingHaiyi Properties and Huajiang International Corporation scooping the prize.

SingHaiyi Properties is a wholly owned unit of Singapore-listed property investor SingHaiyi Group, whose controlling shareholder Haiyi Holdings is owned by Chinese tycoon Gordon Tang and wife Chen Huaidan.

The couple also control the other joint-venture partner, Huajiang International Corporation.

The Sun Rosier deal gave SingHaiyi Group the chance to snap up a site "within an established residential area", the company said in an announcement on the Singapore Exchange website.

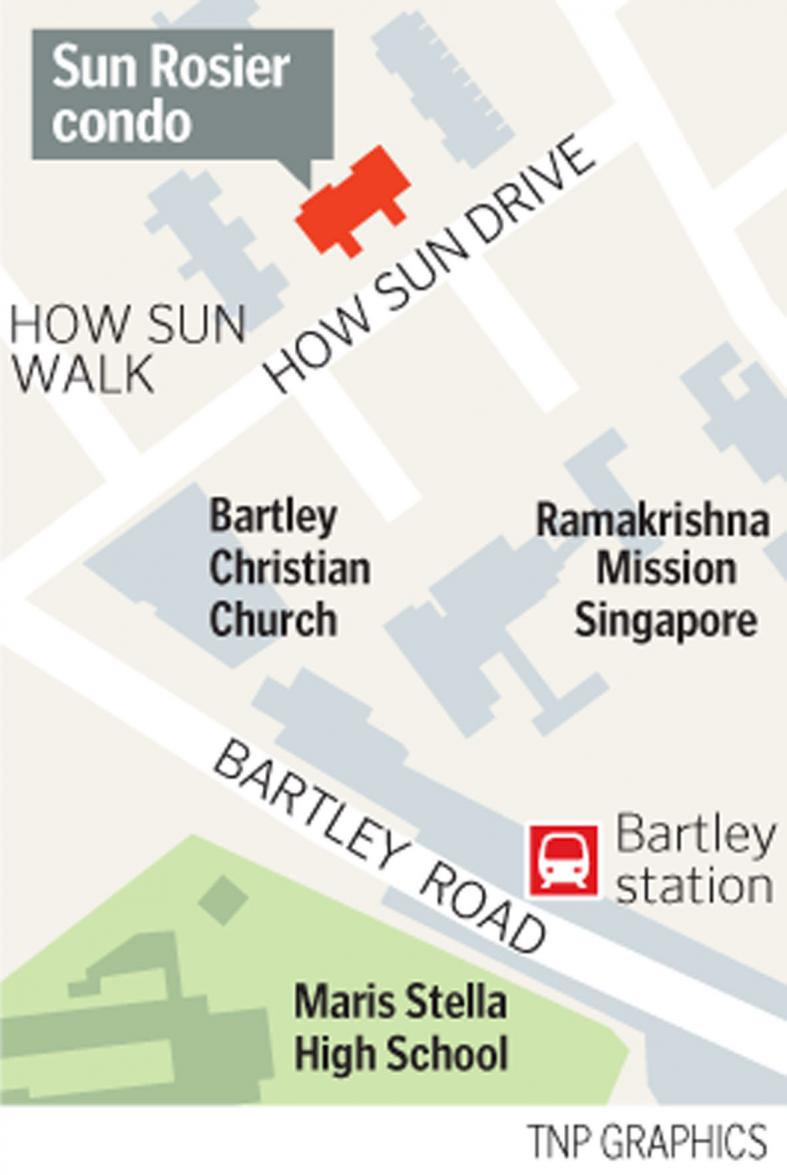

Sun Rosier, in How Sun Drive, is a five-minute walk from Bartley MRT station and is also near several schools, including Maris Stella High, St Gabriel's Secondary and Paya Lebar Methodist Girls' (Secondary).

The condominium, built in 1985, also appeals to developers owing to the relative paucity of freehold development sites, said Mr Stephen Tan, head of collective sales at Huttons.

"We capitalised on this and external factors, such as the strong demand for such sites and the prevailing conditions in the development land market near the upcoming Bidadari estate, to make this (sale) a distinctive success," he said.

The final sum paid by the developer works out to $1,325 psf per plot ratio, based on the site's roughly 146,046 sq ft area.

Edmund Tie & Company research head Lee Nai Jia said "the site offers less risk for the developer" because "the potential development is of the right size".

Its smaller unit yield will make it easier to meet government sales deadlines, while the plot has not been built up enough to warrant paying the development charge for intensified use, Dr Lee noted.

...strong demand for such sites and the prevailing conditions in the development land market near the upcoming Bidadari estate, (made) this (sale) a distinctive success.Mr Stephen Tan, head of collective sales at Huttons Asia

Other real estate prospects have also attracted the interest of Chinese investors this year.

A consortium coughed up $1 billion in May for a residential site in Stirling Road under the government land sales scheme, while in June, a unit of developer Fantasia Holdings paid $75.8 million for a residential parcel in Hougang.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now