Taxing private wealth may affect Singapore's reputation

Taxing private wealth could help tackle inequality and reap huge sums for government coffers but Singapore's reputation as a hub for managing funds held by the well-heeled may take a hit, said analysts.

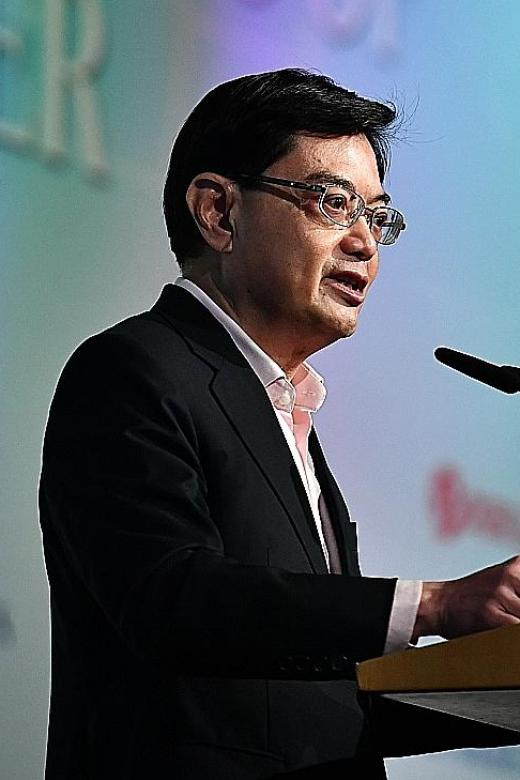

They were reacting to casual remarks made by Finance Minister Heng Swee Keat on Thursday, where he said he had been asked in the week why government revenue has to be raised through taxes when there were huge reserves that could be tapped.

Mr Heng joked: "I don't know if the person who asked the question was someone from the wealth management industry who thought that I was thinking of taxing wealth and trying to divert me from doing that. Unfortunately, he had the opposite effect."

That remark opened up the possibility of a wealth tax and left analysts surprised.

They said it is a tricky tightrope to navigate as levies could take on many forms, from further imposts on property to perhaps the reintroduction of estate tax, which was abolished in 2008.

Analysts said this must be weighed against a potential negative impact on Singapore's status as a major wealth management and financial hub.

"The concept of 'those who have more, should pay more' is easy to understand but hard to execute," said Ms Goh Siow Hui, tax services partner at Ernst & Young Solutions.

She noted that estate duty was abolished as it did not achieve the objective of taxing the wealthy more.

Then finance minister Tharman Shanmugaratnam said it affected the "middle and upper-middle-income estates disproportionately compared to wealthier ones".

The concept of 'those who have more, should pay more' is easy to understand but hard to execute. Ms Goh Siow Hui, tax services partner at Ernst & Young Solutions

Mizuho Bank economist Vishnu Varathan noted this was partly because the truly wealthy would be able to set up trust structures to avoid the estate duty, a levy he believes could be worth revisiting.

"We are an ageing population. You see a lot more inheritance taking place as it is a function of our age profile.

"(And) the value of the estate being bequeathed will also go up dramatically given that property prices have shot up in the last 20 years," he said.

This means if estate duty is re-introduced, it may contribute 1.5 per cent to 2 per cent of government operating revenue annually, up from an annual average of about 0.6 per cent between 2003 and 2007, Mr Varathan added.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now