First Mount Pleasant BTO project to be launched in October

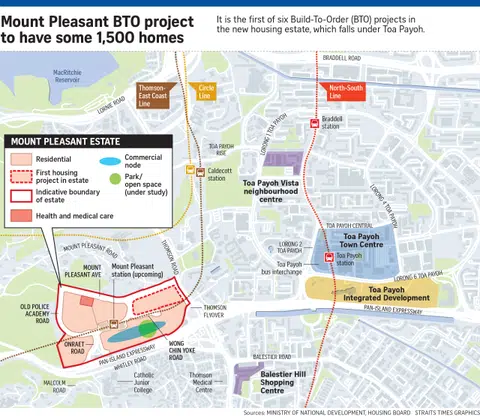

About 1,500 flats under the first Housing Board Build-To-Order (BTO) project in the new Mount Pleasant housing estate will be launched in October.

The project will have two-room flexi, three-room and four-room flats, as well as public rental units in residential blocks that are more than 40 storeys high, said National Development Minister Desmond Lee in Parliament on March 5.

An eatery, a supermarket and shops will be located in the precinct, which is also near the MacRitchie Reservoir.

The 33ha housing estate on the site of the Old Police Academy will house about 5,000 flats in six BTO projects.

Mr Lee said during a debate on the National Development Ministry's (MND) budget that the plans for Mount Pleasant are part of a broader strategy to build affordable public housing in attractive locations.

Bound by Thomson Road and the Pan-Island Expressway, and located close to the mature town of Toa Payoh, the Mount Pleasant area has been earmarked for residential development in the Urban Redevelopment Authority's masterplan since 1998.

Residents will be served by Mount Pleasant MRT station on the Thomson-East Coast Line, which will be opened in tandem with the completion of the BTO projects.

The estate is near the Toa Payoh Integrated Development, which is slated for completion by 2030 and will offer amenities such as a polyclinic, library, park and sports facilities.

The design of the estate will incorporate the area's rich heritage, and six buildings from the Old Police Academy have been conserved.

HDB had previously said the trusses, beams and columns of the old drill shed - one of the earliest buildings to be constructed in the Old Police Academy - could also be incorporated into the estate.

In his speech, Mr Lee also stressed efforts by the Government to keep housing affordable and accessible, such as by ramping up flat supply and the extra subsidies to keep flats in attractive locations affordable under the new flat classification system.

He pointed out that HDB will be launching BTO flats in 60 per cent of towns and estates in 2025.

To help young families secure their first home, he also said a second Sale of Balance Flats (SBF) exercise will be held later in 2025.

SBF exercises were held twice yearly up till 2024, when it was reduced to once a year.

Turning to second-time home buyers, meaning those that had bought a subsidised HDB flat previously, Mr Lee said more of them will be allowed to buy BTO flats from the next sales exercise in July.

He said the proportion of BTO flats set aside for second-timer families was reduced in 2022 to better prioritise first-time home buyers, as application rates among the latter had increased significantly.

First-timer application rates have since come down, and the authorities are aware of concerns from second-timer families who want to buy another subsidised flat, he added.

Moving forward, the quota allocated to second-timer families will be raised by 5 percentage points for three-room and larger flats, said Mr Lee.

In Standard projects, which form the bulk of housing supply and come with a five-year minimum occupation period (MOP), this means 20 per cent of three-room flats and 10 per cent of four-room and larger flats will be set aside for this group of buyers.

Standard flats were offered in towns such as Woodlands, Yishun, Bukit Batok and Sengkang in recent launches.

For Plus and Prime projects, which are in more attractive locations, 10 per cent of three-room and larger flats will be set aside for them. These flats come with a subsidy clawback clause and a 10-year MOP.

Explaining why the authorities have decided to do this, Mr Lee said: "We do not expect significant impact on the application rate for first-timer families, as we are continuing to build more BTO flats to meet demand."

The first-timer family application rate in February's BTO exercise fell to 1.5, down from 3.7 in 2019 and 2.1 in 2024, he added. This means there was a median of 1.5 first-timer families applying for each unit.

Addressing Singaporeans' concerns about resale flat prices, Mr Lee said that a supply-demand imbalance led to high prices - fewer flats reached their MOP in the past few years as fewer homes were completed during the Covid-19 pandemic.

This supply tightness should be alleviated over the next few years, as more flats reach their MOP. He pointed out that about 13,500 flats will reach their MOP in 2026, up from 8,000 in 2025.

Together with cooling measures that are still working their way through the market, the HDB resale market will stabilise, he said.

Mr Henry Kwek (Kebun Baru) and Ms Cheryl Chan (East Coast GRC) asked if the income ceiling for BTO flats and executive condominiums (EC) can be raised.

Responding, Mr Lee said the authorities will keep an eye on income growth and market conditions and will raise the income ceilings when the time is right.

He noted that the current BTO income ceiling - $14,000 for families and $7,000 for singles - covers about eight in 10 Singaporean households.

EC supply in 2025 will be increased to around 1,500 units, up from 1,200 units in previous years, he added. The monthly household income ceiling for ECs is $16,000.

More help for families living in public rental flats

Minister of State for National Development Muhammad Faishal Ibrahim on March 5 gave more details about the enhancements to the Fresh Start Housing Scheme, which supports families living in public rental flats in buying an HDB flat.

Under this scheme, eligible families who are second-time home buyers will get $75,000 in grants to buy two-room flexi or three-room Standard flats on a shorter lease starting from the BTO sales exercise in July. This is up from the current grant of $50,000.

These families will receive $60,000 in their Central Provident Fund (CPF) Ordinary Account before they collect their keys. The remaining $15,000 will be disbursed into their account in equal tranches over five years after key collection, Associate Professor Faishal said.

The Fresh Start Housing Scheme was launched in 2016 to help second-timer families with at least one child below age 18. Applicants must be aged between 35 and 54.

To make the homes more affordable, two-room flexi and three-room flats are offered with leases of 45 to 65 years in five-year increments, as long as the lease can cover the youngest applicant up to age 95.

Flats sold under the scheme have a 20-year MOP to ensure a stable home for the families and children.

From the first BTO exercise in 2026, the scheme will be extended to first-time home-buying families with children that are living in public rental flats to allow them to buy a two-room flexi or three-room Standard flat on a shorter lease, Prof Faishal said.

They can apply to be placed on the scheme from April, and must meet the same eligibility conditions as second-time home buyers.

First-timer families will not be eligible for the $75,000 grant, but can tap the Enhanced CPF Housing Grant, which disburses up to $120,000.

In December 2024, about 52,000 households were living in public rental flats.

MND said about 13,000 families would be eligible for the enhanced Fresh Start Housing Scheme, but expects "a small proportion of a few hundred families" to tap the scheme.

This is because not all eligible families would have the family and financial stability necessary to move on to home ownership, it said.

The ministry estimates the enhancements to the scheme would cost an extra $3 million each year.

Asked why the minimum age for first-time home-buying families is kept to 35, MND said: "Younger parents below the age of 35 have a longer runway to build up their finances and should work towards owning a flat with a longer lease.

"They can consider Fresh Start after they turn 35 if they are still unable to afford a flat with a longer lease."

But HDB will consider the circumstances of each case and can allow younger families to tap the scheme if the authorities assess that Fresh Start is "the best pathway to home ownership for them", MND added.

Prof Faishal said 85 families have bought homes under the Fresh Start Housing Scheme, and another 28 have booked flats.

More than 700 public rental families moved into their own homes in 2024, he added.

Isabelle Liew for The Straits Times

- SINGAPORE PARLIAMENT

- PUBLIC HOUSING

- hdb

- Ministry of National Development

- DESMOND LEE

- Muhammad Faishal Ibrahim