Singapore manufacturing falls in April, ending 19-month growth streak

Manufacturing activity in Singapore fell into recession territory in April as tariffs announced by US President Donald Trump triggered a wave of export-order deferments and cancellations.

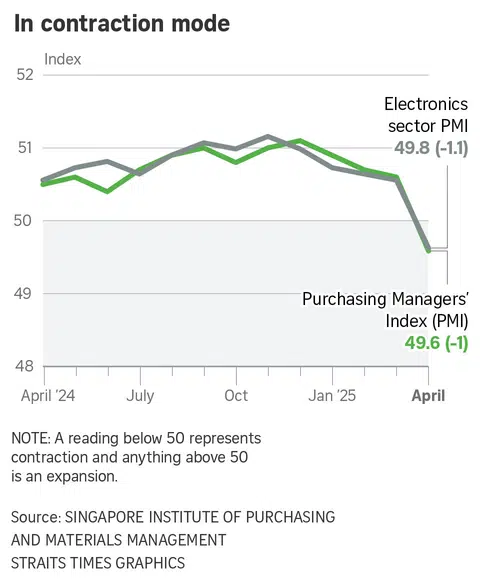

The purchasing managers' index (PMI), a barometer of the manufacturing sector's health, fell to 49.6 points in April, down one point from 50.6 in March.

Readings above 50 indicate growth while those below point to contraction.

The contraction in Singapore's factory activity snaps 19 straight months of expansion, said the Singapore Institute of Purchasing and Materials Management (SIPMM), which issued the report on May 2.

The last time the manufacturing PMI was below 50 was in August 2023 when it stood at 49.9 points, SIPMM data showed.

Mr Stephen Poh, SIPMM's executive director, said the US tariffs have started to take a toll on the local manufacturing sector.

"Local manufacturers reported order deferments and cancellations from foreign buyers who were greatly affected by the high reciprocal tariffs," he said.

The PMI for the electronics sector - which accounts for about 40 per cent of Singapore's manufacturing output - dropped by 1.1 points to 49.8 points for the first contraction after 17 months of expansion.

Mr Chua Han Teng, senior economist at DBS Bank, said the PMI decline was the steepest observed since the onset of the Covid-19 pandemic in early 2020.

It looked consistent with the deteriorating business sentiment among manufacturing firms for April to September 2025, as shown by the Economic Development Board quarterly survey on April 30, he added.

Trade tensions and uncertainty over the global economic outlook have risen since April 2 when President Trump announced a raft of tariffs. A 90-day pause was declared on the higher-band levies, dubbed reciprocal tariffs.

However, all countries including Singapore are subject to a baseline tariff of 10 per cent.

China, Singapore's top trading partner, is the only country that is still subject to US tariffs announced on April 2 and which were subsequently raised to an unprecedented level of 145 per cent.

The 25 per cent sectoral levies on all US imports of steel, aluminium, and automobiles and parts remain in place as well. Also, Mr Trump has threatened to impose similar levies on imports of pharmaceuticals and semiconductors.

SIPMM said the latest manufacturing PMI reading was attributed to a first-time contraction in the key indexes of new orders, factory output and employment.

Slower expansion rates were recorded for new exports and imports, and input purchases. The future business index reverted to a contraction after posting 21 months of continuous expansion.

Meanwhile, supplier deliveries, finished goods and order backlogs posted faster expansions.

For electronics PMI, the latest reading was attributed mainly to a first-time contraction in new exports, factory output and employment.

Slower expansions were recorded for new orders, input purchases, finished goods and imports.

Meanwhile, faster expansions were recorded for supplier deliveries and order backlogs. Both the input prices and future business indexes reverted to contraction.

Mr Chua said: "Softer new export orders reflect weakened external demand for Singapore's manufactured goods, including electronics, which also spilled over negatively to production and employment."

The weakness in PMI data also comes on the heels of a Monetary Authority of Singapore (MAS) report on April 28 which showed industrial production moderating to an annual 4 per cent growth in the first quarter of 2025 from 5.5 per cent in the fourth quarter of 2024.

MAS said the output was mainly weighed down by slower activity in the electronics cluster.

On April 14, the Ministry of Trade and Industry (MTI) said Singapore's seasonally adjusted gross domestic product contracted by 0.8 per cent quarter on quarter in the first three months of 2025, a pullback from the 0.5 per cent expansion in the last quarter of 2024.

MTI downgraded the Republic's growth forecast to 0 per cent to 2 per cent from 1 per cent to 3 per cent previously. Singapore's economy grew 4.4 per cent in 2024.

Mr Chua said Singapore remains vulnerable to the heightened unpredictability and uncertainty from the "US tariff roller coaster".

"A more protectionist global landscape led by higher US tariffs will further dampen external demand, negatively impacting Singapore's manufacturing prospects, especially in the second half of 2025," he added.

Manufacturing and exports around the world are showing early damage from US tariffs and trade uncertainty.

In China, factory activity in April slipped into the worst contraction since December 2023.

Manufacturing activity in the US, Singapore's second-biggest trade partner, shrank for the second straight month in April, dropping to a five-month low.

For the rest of Asia, April factory activity contracted in South Korea, Taiwan, Thailand, Malaysia and Indonesia. The Philippines was the standout, as the upcoming local elections drove its PMI into expansion territory.

Ovais Subhani for The Straits Times