Writing on the wall for SMS: Banks, govt groups moving to soft tokens

The roll-out of software-based, or soft, security tokens by banks and government agencies is set to speed up the decline of the humble SMS.

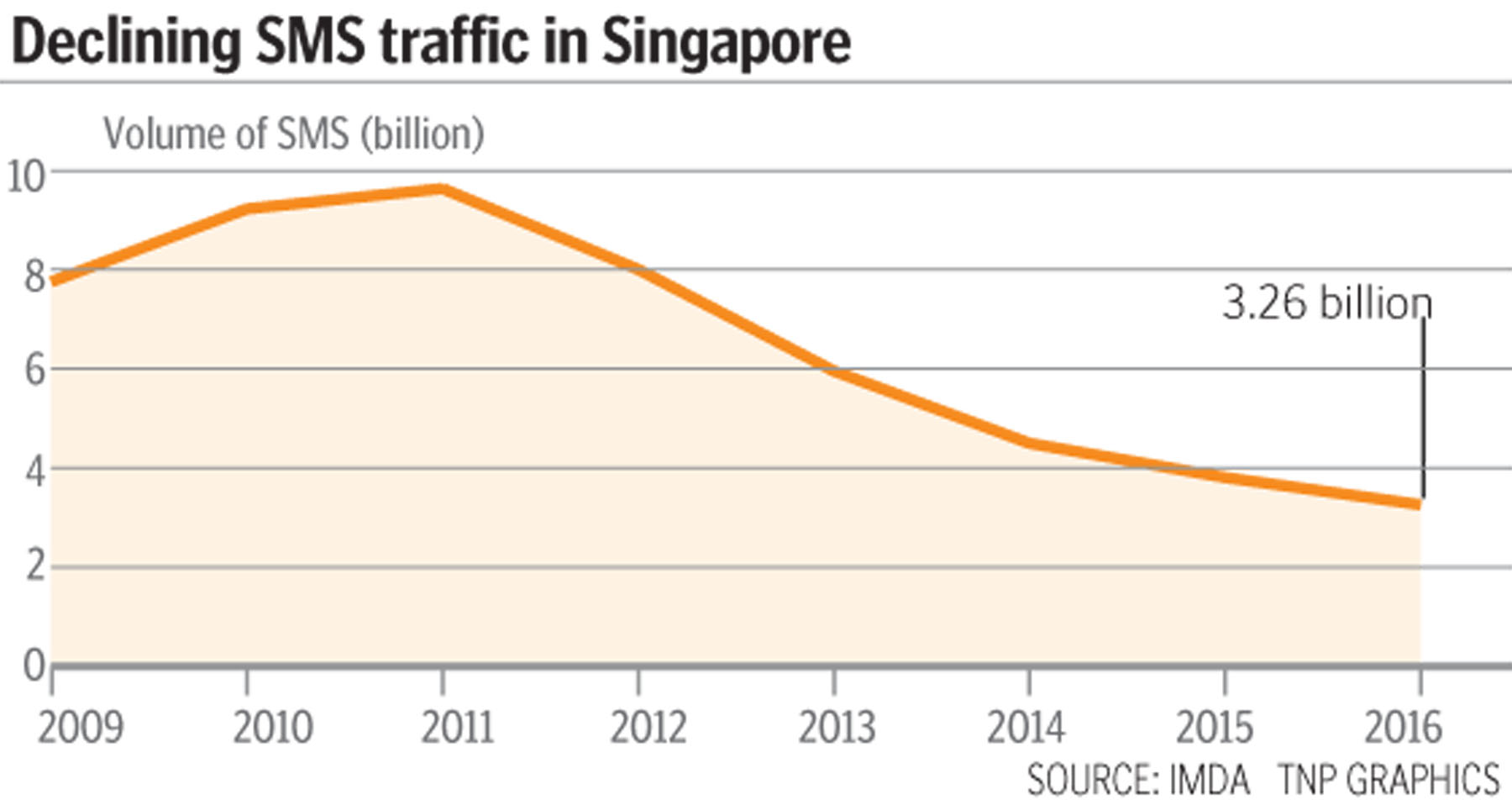

The popularity of SMS, or Short Message Service, has been steadily falling since peaking at 9.64 billion sent messages in 2011, according to the Infocomm Media Development Authority (IMDA). Last year, only 3.26 billion messages were sent over the mobile networks of the three local telcos Singtel, StarHub and M1.

Consumers here are ditching the platform in favour of mobile apps such as WhatsApp and WeChat, which work with Wi-Fi and mobile data connections and can result in significant savings when communicating with a fellow user overseas.

And now, even organisations such as banks and government agencies - which have been sending out one-time passwords (OTPs) via SMS for securing online transactions - are set to move on.

Soft tokens appeal to customers as they are as convenient as SMS and can be installed in smartphones without requiring another device.

Soft tokens are also as safe as hard tokens; security experts have said that SMS OTPs are vulnerable to interception by hackers.

United Overseas Bank started the ball rolling in December last year with the launch of its soft token, followed by DBS Bank in April and Citibank in June.

More than 200,000 DBS and POSB customers have already registered to use the soft tokens, which will eventually supplant hardware tokens as well as SMS-based OTPs.

GOVERNMENT AGENCIES

The Straits Times understands that the retail banking industry alone accounts for about 500 million SMS sent a year.

Another major SMS user is government agencies.

Amid fears that SMS OTPs are not safe, the Government is also working with digital security systems maker Gemalto, among others, to develop a soft token that will allow citizens to transact more safely with government agencies.

Defending the longevity of SMS, M1 and StarHub said it is the "most ubiquitous" messaging platform as users do not need to download any app.

One key use is public emergency notification, such as the system StarHub developed and launched in October last year for the Ministry of Home Affairs.

The system alerts the public via SMS if there is a major emergency, be it a fire or a terror attack, near mobile users' location.

A Singtel spokesman said it will continue to provide SMS when there is demand for it, noting: "Consumers also see value in (SMS) when travelling to countries where 3G or 4G data coverage is limited."

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now