'You feel like you will lose everything': Woman loses $250k to 'government official' scammers

The scammers accused Sabrina Tan of money laundering, demanding cash to prove her innocence.

It was in May that Sabrina Tan (not her real name) received a chilling phone call.

Police officers would take her from her own home, she was told, and a black cloth thrown over her head.

They would then deport her to China in handcuffs to be investigated for money laundering.

A month of psychological manipulation followed, where "policemen" repeatedly accused her of money laundering and demanded that she comply with their orders to prove her innocence.

Fearing for her and her family's safety, Mrs Tan, in her 40s, could only comply with their instructions.

Ultimately, she handed over $250,000 in cash to the scammers in a bid to prove her innocence.

'Everything was so real'

In an interview with reporters facilitated by the Singapore Police Force (SPF), Mrs Tan, who works in the manufacturing industry and has a three-year-old child, related her experience of being scammed.

In April, she received a call from someone claiming to be from Air China, stating that she had bought flight tickets from the company.

As the conversation unfolded, the caller told Mrs Tan that her identity had been stolen, and she was under investigation.

After "forwarding" the call to the Chinese police - Mrs Tan later found out this was actually another team of scammers - she was accused of money laundering and told to give the scammers personal information to plead her case.

"Everything was so real," Mrs Tan said, explaining that the scammers had shown her fake identification to convince her of their legitimacy. "They wanted you to feel confident that they are not scammers."

Manipulated and isolated

The "police" proceeded to instruct her to send photos of herself and her location every two hours, and to sign a non-disclosure agreement, which further isolated her from others.

The repeated calls started to take a toll: "All this somehow made me lose my energy bit by bit."

The scammers eventually demanded $250,000 in cash, so that they could trace where the money had come from and hence clear her of wrongdoing.

Even when her bank froze her account and Anti-Scam Officers tried to dissuade her from making the withdrawal, the scammers pressured her to ignore their warnings.

She told the bank she needed to settle a gambling debt, and requested access to her account. She was able to do so after signing a waiver declaring that she had been warned by the bank, which held no responsibility if she was scammed.

"I'm just too tired of going through this, and I don't know when this is going to end," she said, recounting the moment she handed over the money.

"They make you feel like you are going to lose everything," she recalled. "They just try to pressure you to have this mental breakdown."

Police alerted to scam by money mule

Assistant Superintendent of Police and Senior Investigation Officer Steven Lee, told reporters that he was alerted to the case on May 27.

"A young money-mule reported that he had received $362,000 from three victims," said ASP Lee, adding that a follow-up investigation identified the victims.

Like the scam victims, the money mule was told he was under investigation for money laundering, and that collecting the money would prove his innocence.

In June, the $250,000 was eventually recovered.

"Our priority is to get back as much money or the full sum of the scam money for the victims," ASP Lee said.

Government impersonation scams tripled

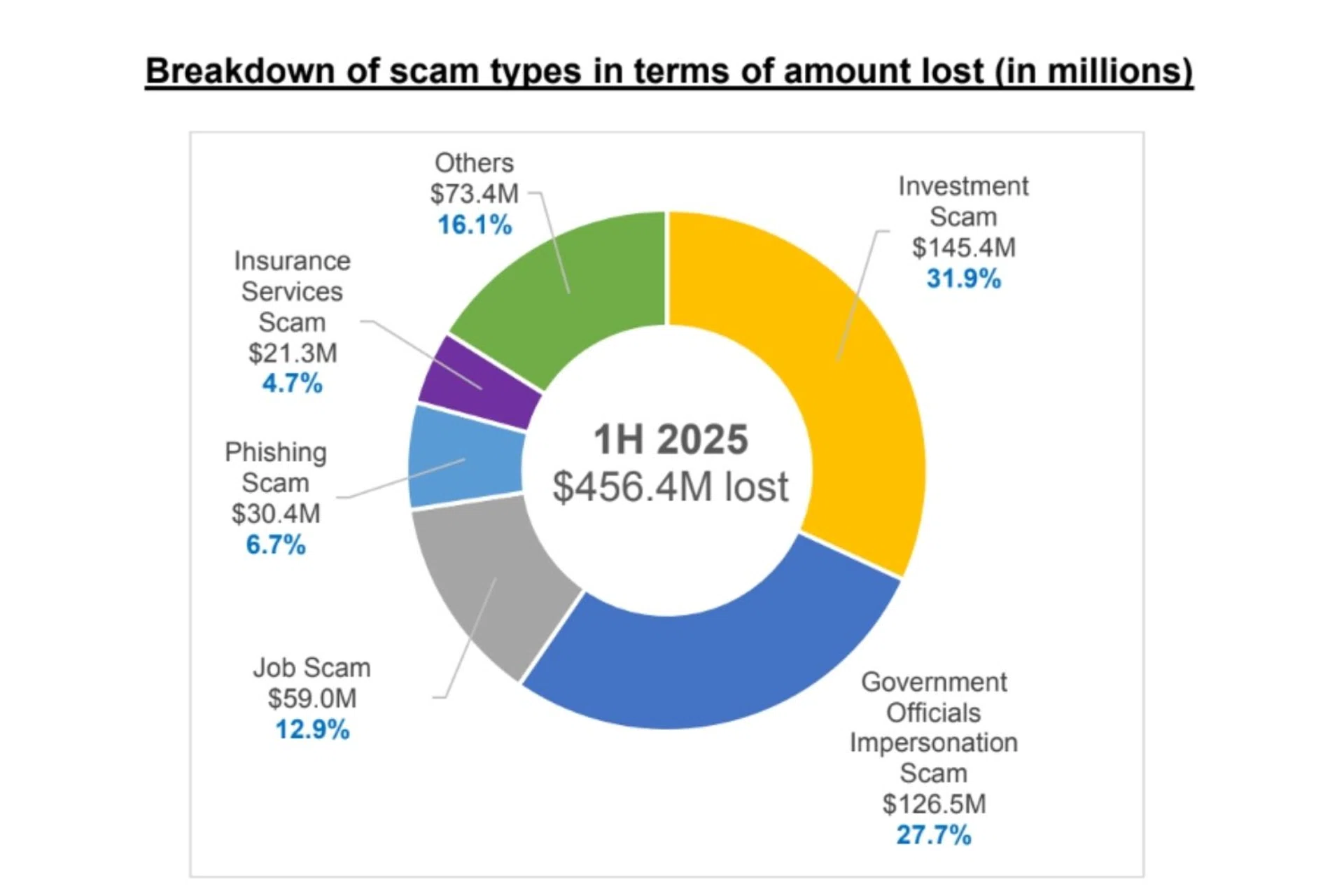

According to SPF's mid-year scam and cybercrime brief released on Aug 30, government official impersonation scams remain a priority.

The number of such cases reported almost tripled year-on-year, increasing by 199.2 per cent to 1,762 cases in the first half of 2025, from 589 cases during the same period last year.

Such scams recorded the second-highest loss among all scam types in the first half of 2025.

Police said there has also been a rising trend of victims being pressured to withdraw cash and meet mules in-person to hand over valuables, allegedly for investigative purposes.

New law allows police to restrict bank accounts

For Mrs Tan, her conviction that she was not being scammed was a key reason the perpetrators succeeded in manipulating her.

"I think the banks did their best to prevent me from taking out my money, but I was very persistent," she said. The scammers had also convinced Mrs Tan that the police could not be trusted.

In such cases when the victim cannot be persuaded otherwise, a new law has been put in place which authorities say will offer added protection.

The Protection from Scams Act, which came into effect on July 1, empowers the police to issue restriction orders (RO) on bank accounts of suspected scam victims, preventing them from withdrawing or transferring funds.

Authorities say ROs are issued as a last resort, when all other methods to convince a scam victim have been exhausted. As of Aug 20, two ROs have been issued.

Asked about the new Act, Mrs Tan expressed concerns about the effectiveness of ROs, while acknowledging that such preventive measures are necessary.

"There will always be a way out," she said. "I think those people who need the money for real may suffer."

More can be done: Experts weigh in

Commenting on the new legislation, National University of Singapore's (NUS) Benjamin Wong, who specialises in data protection law, said that the new law balances individual autonomy against the need for protection against scams.

"There are minimal (if any) data privacy implications," said Mr Wong, noting that the Act does not confer additional power to banks, except to do what is needed.

Although inconvenience could be a trade-off, several safeguards serve to minimise this inconvenience, such as the ability to apply for permission to make necessary bank transactions.

However, Associate Professor Sandra Annette Booysen, director of the Centre for Banking and Finance Law, suggested that while the new law does prevent victims from being scammed out of large amounts of money, more can be done.

"It can address only a small portion of the scam problem, and the number of cases in which victims are shielded from scams in this way is going to be small, relative to the size of the scam problem," she told TNP.

Pointing out that the number of ROs issued per month is low, around 10, she stressed the need for a "more holistic solution" instead, given the severity and pervasiveness of the issue.

This includes the role of banks in detecting scams, telecommunication service providers in blocking unauthorised transactions under the Shared Responsibility Framework, and the importance of security on online service platforms under the Online Criminal Harms Act.