Singapore tax revenue up 5 per cent to $47 billion

Inland Revenue Authority of Singapore releases annual report

The Inland Revenue Authority of Singapore (Iras) raked in tax revenue of $47 billion in the fiscal year 2016, about 5 per cent more than the previous year.

Economists cited a turnaround in manufacturing in the second half of last year as well as a recovery in property sales that started in the fourth quarter.

The Iras annual report yesterday said the rise was "supported by the expansion of Singapore's economy by 2 per cent in 2016 and low unemployment rate of 2.1 per cent".

Its collections accounted for 68.2 per cent of the government operating revenue (GOR).

This amount accounted for 11.3 per cent of Singapore's gross domestic product.

OCBC Bank economist Selena Ling said the global and local economy "bottomed in mid-2016, and the second half of 2016 saw a turnaround, especially in manufacturing".

She added: "Since the domestic labour market remained relatively healthy in 2016, that may explain why individual income tax as well as GST receipts improved."

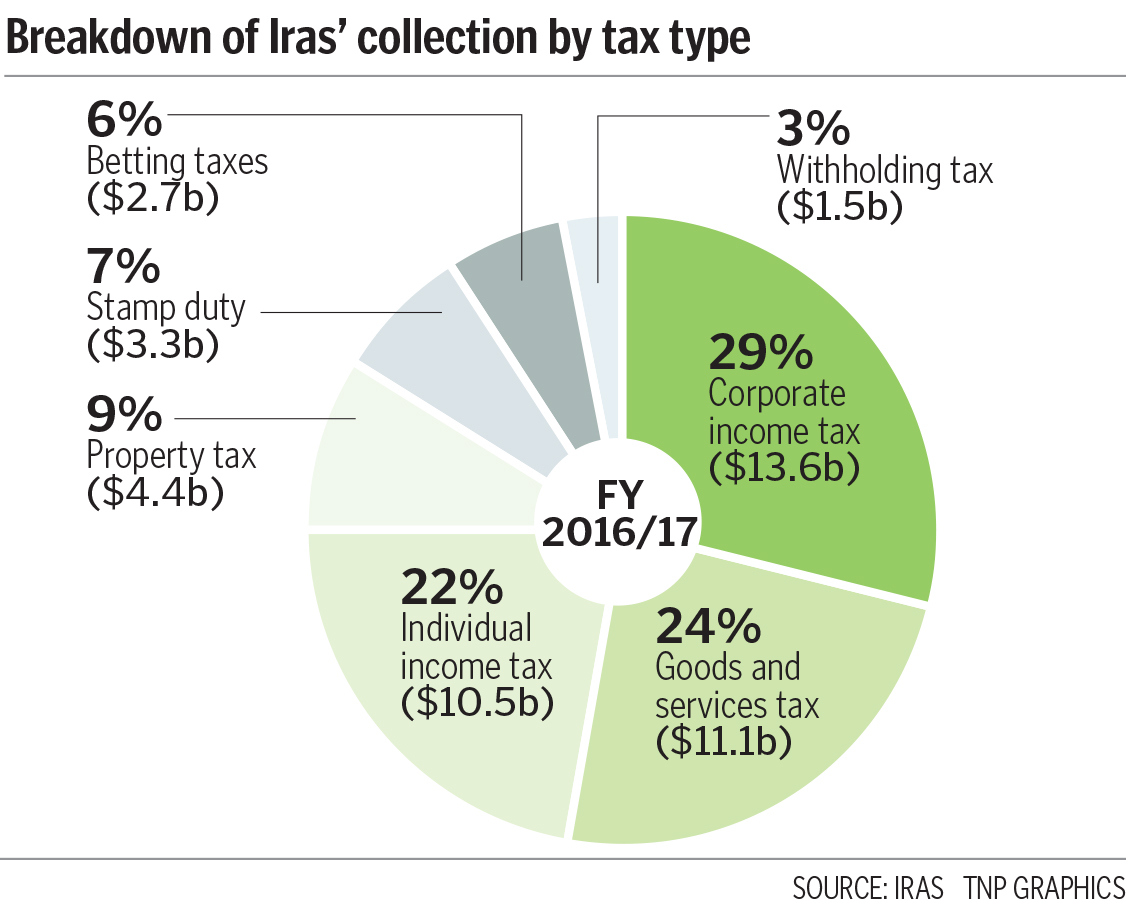

Income tax comprising corporate income tax, individual income tax and withholding tax made up 54 per cent of Iras' collection for the 12 months ended March 31.

-

$1.96 billion

The income tax paid by those earning assessable income above $1 million.

The total was $1.1 billion over the previous financial year owing to a jump of 14 per cent, or $1.3 billion, in individual income tax collection, due to higher individual earnings and cessation of one-off personal rebates given in YA 2015. But corporate income tax slid 1.6 per cent to $13.6 billion year on year.

More taxpayers here joined the millionaires' club.

The number of those earning assessable income above $1 million rose 6.9 per cent to 5,524. Their combined assessable income was $10.6 billion and they paid $1.96 billion in income tax.

Stamp duty collection jumped 18.4 per cent to $3.3 billion after a rise in property transactions.

Maybank Kim Eng economist Chua Hak Bin said stamp duty collections were boosted by a 42 per cent jump in private residential sales in the fourth quarter of last year and an 89 per cent surge in the first quarter this year.

In 2016/17, Iras uncovered 10,626 non-compliant cases and recovered about $332 million in taxes and penalties through audits and investigations.

Goods and services tax collection rose to $11.1 billion from $10.3 billion a year earlier, while property tax collection slid 2.1 per cent to $4.4 billion.

Betting taxes - betting duty, casino tax and private lotteries duty - totalled $2.7 billion, down 1.4 per cent.

Dr Chua said the budget surplus position for the year may turn out better than expected, and further income tax and GST rises may not be necessary.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now